Penalty for Not Paying Quarterly Taxes: How to Avoid It

If you're self-employed or earn income without tax withholding, you might be on the hook for quarterly taxes. Missing these payments can lead to penalties from the IRS - but many business owners don't realize this until it's too late.

So, what is the penalty for not paying quarterly taxes? There's no one fixed amount. The IRS charges a penalty based on how much you underpaid and how long you waited to pay. Here's everything you need to know to avoid the estimated tax penalty and keep your business in good standing.

What Are Quarterly Taxes?

Unlike employees who have taxes automatically taken from their paychecks, business owners, freelancers, and independent contractors need to handle their tax payments throughout the year. The IRS expects you to pay as you earn, not just once at tax time.

So, you can think of quarterly taxes as advance payments toward your annual tax bill.

Instead of paying one large sum when you file your tax return, you make four smaller payments throughout the year. These payments cover not only income tax but also the self-employment tax (Social Security and Medicare).

Learn how much to set aside for taxes as a real estate agent.

Who Must Pay Quarterly Taxes?

The IRS requires quarterly tax payments when your annual tax bill will likely go over $1,000. This typically applies to:

Self-employed people and small business owners

Freelancers and independent contractors

People with rental income

Investors with income from dividends or interest

Anyone with income that isn't subject to tax withholding

For example, if you run a copywriting business that's expected to make $75,000 this year, you'll likely need to make quarterly payments. According to the IRS, self-employed people must make estimated tax payments if they earn $400 or more in net income.

When Are the Quarterly Payments Due?

The IRS sets four specific due dates for quarterly estimated payments:

April 15

June 15

September 15

January 15 of the following year

These dates don't split the year into even quarters, which often confuses business owners. If any due date falls on a weekend or holiday, your unpaid tax is due the next business day. Missing these deadlines, even by a day, can trigger the underpayment of estimated tax penalties.

Learn more about how much small businesses can expect to pay in taxes.

Is There a Penalty for Not Paying Quarterly Taxes?

Yes, the IRS charges a penalty if you don't pay enough quarterly taxes or pay them too late. The penalty works like an interest charge - the longer you wait to pay, the more you'll owe.

The IRS calculates your penalty based on:

How much you underpaid

How long you waited to pay

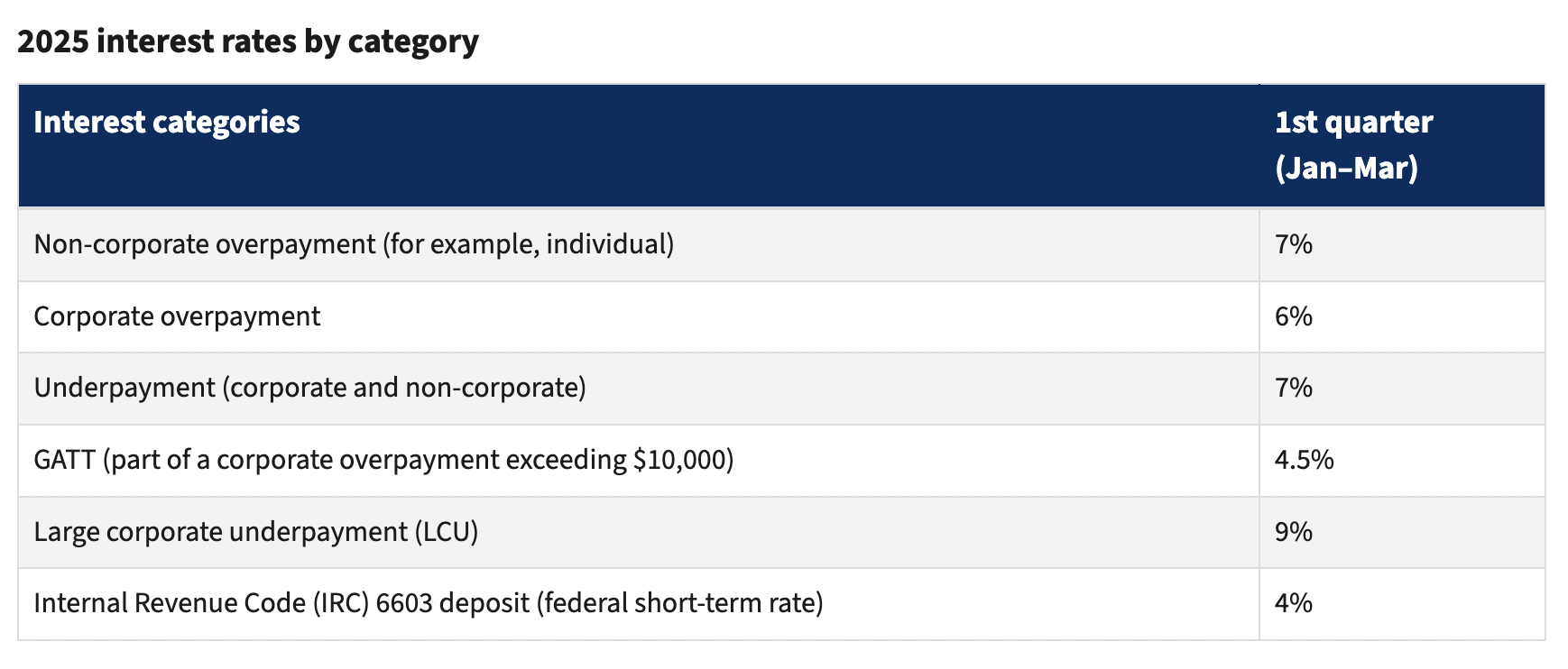

The current interest rate (which changes quarterly)

For example, here's the 2025 interest rates for Q1:

Source: IRS.

Overall, make sure to pay estimated taxes on time to avoid the underpayment penalty. If you need help with your tax obligations, learn more about our services!

How to Estimate Quarterly Taxes

The simplest way to estimate your payments is to use last year's income tax return as a starting point. Look at your taxable income and expenses from last year, then adjust these numbers based on what you expect to earn and spend this year.

Once you have these estimates, calculate your total tax liability by adding together your income tax and self-employment tax. Then simply divide this amount by four to get your estimated quarterly payment.

Here's an example. Let's say you expect to make $80,000 in self-employment income:

Self-employment tax: $80,000 × 15.3% = $12,240

Income tax (assuming 22% bracket): $80,000 × 22% = $17,600

Total tax: $29,840

Quarterly payment: $29,840/4 = $7,460 per quarter

As a small business owner, your income might naturally vary throughout the year. You can adjust your quarterly payments up or down as your income changes, but many business owners set aside 25-30% of their income for taxes.

How to Avoid Penalties for Not Paying Quarterly Taxes

The best way to avoid penalties is to pay the right amount on time. So, set calendar reminders for each due date and keep good records of your income and expenses. Working with a tax professional can help with this if numbers aren't your thing!

If you can't make the payment by the due date, you can apply for an extension of time to file or a payment plan with the IRS.

When the Penalty Is Waived

The IRS may waive the penalty for not paying quarterly taxes in certain situations.

You're automatically exempt if you owe less than $1,000 in taxes for the year. You'll also avoid penalties if you've paid either 90% of this year's tax bill or 100% of last year's tax liability, whichever is less.

Other situations where the IRS might waive the penalty include:

You didn't owe any taxes last year and were a US citizen or resident

You missed payments due to a natural disaster or unusual circumstance beyond your control

You retired after age 62 during this tax year or the previous year

You became disabled during this tax year or the previous year

You had a reasonable cause for underpayment and weren't simply negligent

For example, if a hurricane damaged your business records or your primary income source suddenly ended, the IRS might waive your penalty.

The Online Tax Payment Guide

Access this FREE Online Tax Payment Guide to get step-by-step instructions on how to make your payment online.

What to Do If You've Already Missed a Payment

If you've missed a quarterly payment, pay what you can as soon as possible. The penalty grows over time, so paying late is better than not paying at all. You can also sometimes set up a payment plan with the IRS if you can't pay the full amount right away.

FAQs

What Happens If You Don't Make Quarterly Tax Payments?

Missing quarterly tax payments can result in penalties and interest charges from the IRS. They'll calculate your penalty based on how much you underpaid and how long you waited to pay. You should make estimated tax payments by April 15, June 15, September 15, and January 15 of the following year.

Are IRS Quarterly Payments Mandatory?

You have to make quarterly tax payments if you expect to owe $1,000 or more in taxes.The IRS designed this system to collect taxes from self-employed people and business owners throughout the year, similar to how employers withhold taxes from employee paychecks.

Does It Make Sense to Pay Quarterly Taxes?

Paying quarterly taxes makes financial sense because it helps you avoid IRS penalties and manage your cash flow throughout the year. Instead of facing one large tax bill in April, you make four smaller payments that can be adjusted depending on how much you expect to make.

Is There a Penalty for Not Paying Quarterly Taxes as a 1099?

Yes, 1099 contractors face the same penalties as any other self-employed person for missing quarterly tax payments. The IRS doesn't distinguish between different types of self-employment income when assessing penalties - if you receive 1099 income and expect to owe $1,000 or more in taxes, you need to make quarterly payments to avoid penalties.

Learn more about the differences between 1099-MISC vs 1099-NEC.

Do Independent Contractors Have to Pay Quarterly Taxes?

Yes, independent contractors must pay quarterly taxes if you expect to owe $1,000 or more in annual taxes. This is because your clients don't withhold any taxes from your contractor payments, so it's your responsibility to keep up with them.

Does a Single-Member LLC Pay Quarterly Taxes?

A single-member LLC that hasn't elected to be taxed as a corporation will need to pay quarterly taxes if it meets the same thresholds as other self-employed individuals.The IRS treats single-member LLCs as "disregarded entities" for tax purposes, which means that you as the owner need to report your business income on your personal tax return and follow the same quarterly tax payment schedule as sole proprietors.

Is It Better to Pay Taxes Quarterly or Yearly?

Paying quarterly taxes is generally better than paying yearly because this way you avoid penalties and managing your business finances becomes easier. Paying once a year may sound simpler, but it can lead to a real financial strain when a large tax bill comes due. Quarterly payments help prevent unpleasant surprises like that.

Get Clarity with Your Estimated Tax Payments and Beyond

If you freelance or run your own business, it's very important to understand quarterly tax payments and the fact that there's a penalty for not making them on time. If you're unsure what your tax obligations are or need help, consider working with a tax professional.

At Desi Tax, we help small business owners find clarity in tax season and start saving money you didn't know you had. Learn more about our services!